Hong Kong-listed property firms donate over US$2 billion

China Evergrande was the biggest donor among Hong Kong-listed property companies last year. Photo: Reuters

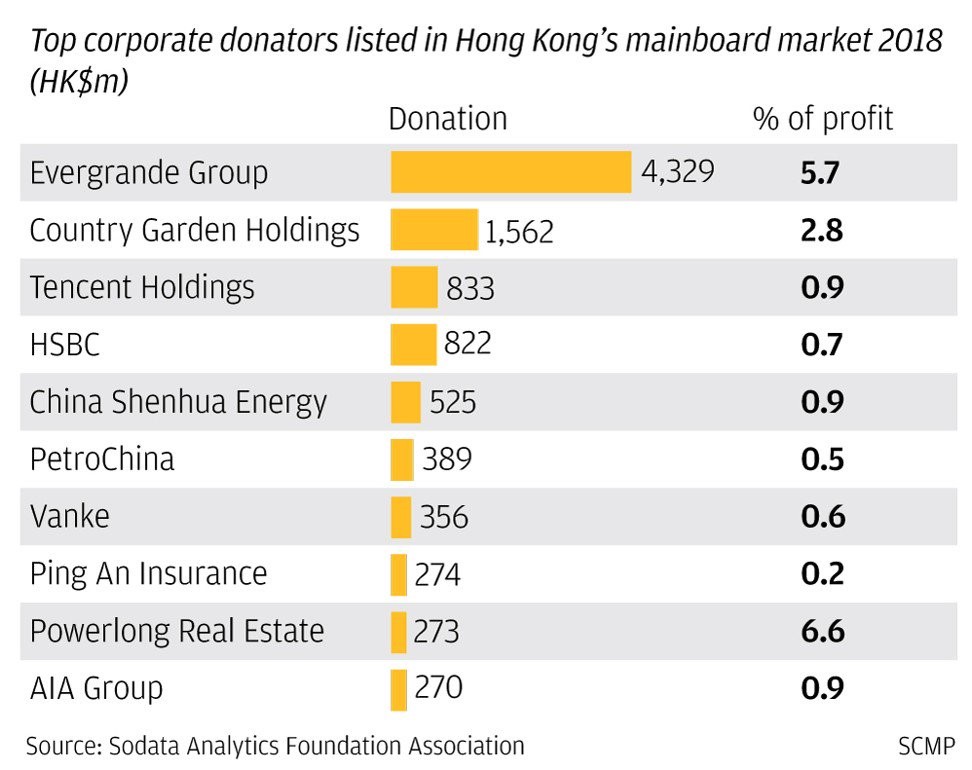

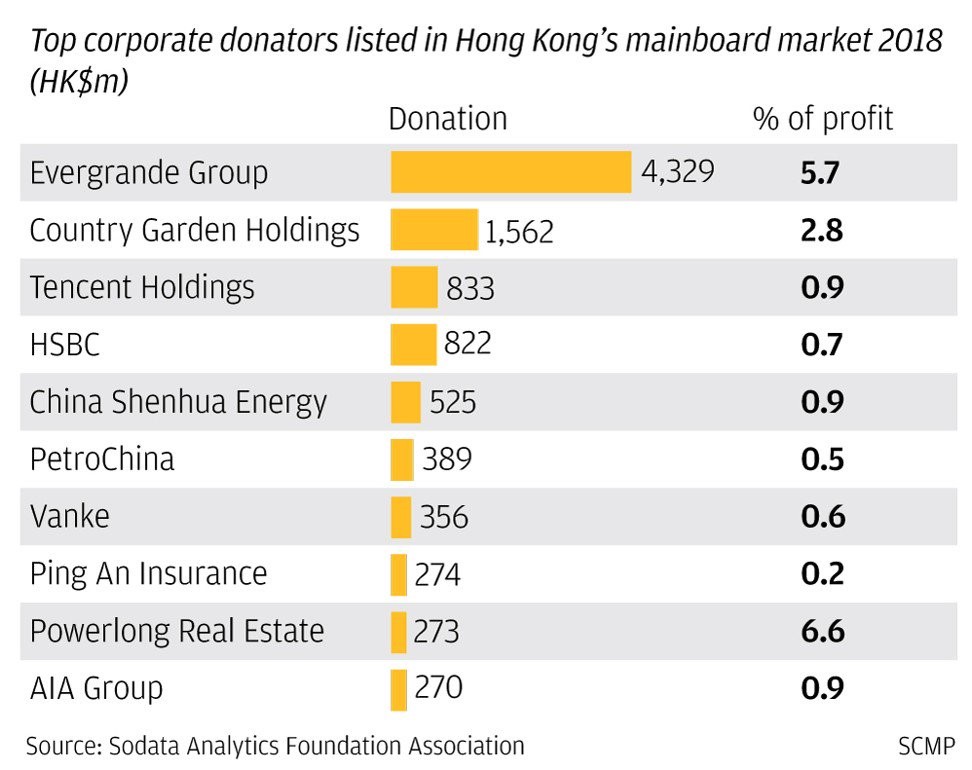

Property and financial companies have topped the list of donors among Hong Kong-listed firms for a second straight year, according to a study by Sodata Analytics Foundation Association.

Property firms, led by mainland China-based developers, donated around HK$8.1 billion (US$1.03 billion) in 2018 and 2017 respectively, followed by financial firms’ HK$3.6 billion in each of the past two years, based on disclosures in their annual reports.

The average donation of the 220-odd real estate firms was HK$34.2 million each in 2018 versus HK$20 million for financial companies, according to the non-government organisation, which has been tracking listed firms’ donations since 2013.

The association’s Sodata index, tracking 100 firms that scored the highest on donations amount, growth rate and continuity, has gained 7 per cent since its debut on June 2, 2015 – outperforming the Hang Seng Index’s 5.5 per cent decline.

“Over the past three years, the highest ranked 100 firms showed higher returns [for investors] and lower [share price] volatility,” said the association’s founder Michael Yip, who is also chief financial officer of Rising Glory Finance.

However, the Sodata index fell 2.9 per cent year to date, underperforming the Hang Seng’s 3.8 per cent gain.

Gabriel Wilson-Otto, head of Asia-Pacific stewardship at BNP Paribas Asset Management, said it is hard to show a reliable correlation between a company’s donations and its financial and share price performances.

“Companies with higher profitability will often have more cash and more scope to make donations, while those facing cost pressure and increasing competition may cut back on donations unless they give them a competitive advantage or a social licence to operate,” he said.

“But this isn’t always the case; you could have a company that donates a certain sum every year that doesn’t [correspond with] increased profitability, so there could potentially be some link but not necessarily a strong correlation.”

Tencent Holdings donated HK$833 million. Photo: Reuters

Tencent Holdings donated HK$833 million. Photo: Reuters

The difference between donations and wider measures of companies’ ESG (environment, social and governance) performance is that the latter involves the examination of a wider scope of critical factors relating more concretely to companies’ operations, Wilson-Otto noted.

“Poor governance or an extreme human rights or environmental violation can result in a company’s share price going to zero. Not giving donations to charity is unlikely to be the key factor that makes a company go out of business.”

ESG funds, whose fund managers are mandated to consider ESG factors on top of financial performance when making asset allocation decisions, are projected to grow by over US$20 trillion in asset values in the next two decades, according to Bank of America Merrill Lynch.

“A strategy of buying stocks that rank well on ESG metrics would have outperformed the market by up to three percentage points per year over the last five years,” the bank’s strategists said in a recent report.

Li Ka-shing, Hong Kong’s richest man, has donated more than HK$25 billion to charitable causes over the past several years. Photo: Sam Tsang

Li Ka-shing, Hong Kong’s richest man, has donated more than HK$25 billion to charitable causes over the past several years. Photo: Sam Tsang

China Evergrande Group ranked first in the past two years, according to Sodata’s study. It donated HK$4.3 billion last year – 5.7 per cent of its profit, and HK$5 billion in 2017 – 11.3 per cent of profit.

The Shenzhen-based property developer had committed four years ago to donate 11 billion yuan (US$1.53 billion) towards a poverty alleviation plan it initiated for the Wumeng mountainous region near Bijie city in the impoverished Guizhou province in southwest China, its annual report said.

Evergrande was followed by Foshan, Guangdong-based developer Country Garden Holdings, which donated HK$1.56 billion last year, and Tencent Holdings’ HK$833 million.

Eight of last year’s top 10 donors, barring HSBC and pan-Asia insurance giant AIA Group, were from mainland China.

Some blue chip firms controlled by Hong Kong tycoons, who are known for their charity work in their personal capacity instead of their listed flagships, were not on the list.

Tycoon Li Ka-shing donates HK$1 billion to help Hong Kong businesses survive city’s protest crisis

For example, Asia’s richest man Li Ka-shing has over the years provided over HK$25 billion – mostly in Greater China – to many philanthropic projects and charities, according to the website of his namesake foundation. Some 82 per cent of which was spent on education and health care projects.

His 39-year-old foundation on Friday announced a donation of HK$1 billion to help small and medium-sized firms hit hard by anti-government protests in Hong Kong.

Li’s listed infrastructure-to-retail conglomerate CK Hutchison has organised staff volunteers to perform community services, fundraising and food donation drives to help those in need in Hong Kong, while its overseas units have donated some HK$4.5 million to charities.

The tycoon’s other listed property unit CK Asset gave HK$6 million to charity last year, according to its annual report.